Taxes

Rice Farmer Rebellions

By DANIEL WEISS

Tuesday, March 23, 2021

During the Tokugawa era (A.D. 1603–1868), much of Japan was ruled by the country’s military governor, called the shogun, or his retainers. The rest was divided up into several hundred semiautonomous domains overseen by powerful samurai known as daimyo. In these domains, the daimyo were free to set tax rates on local peasants as they saw fit. This included the most important tax, nengu, which claimed a portion of each domain’s rice yield. According to records from 1868, nengu rates varied wildly across these domains, from 15 percent to as much as 70 percent. Curious to see whether peasants had any impact on the rates they were subjected to, a team of researchers including Abbey Steele, a University of Amsterdam political scientist, analyzed the relationship between nengu rates and peasant tax rebellions recorded throughout the Tokugawa era. These revolts included hanran, large rebellions typically including thousands of peasants, and chosen, mass desertions in which peasants abandoned their fields and threatened not to return until their demands were met.

During the Tokugawa era (A.D. 1603–1868), much of Japan was ruled by the country’s military governor, called the shogun, or his retainers. The rest was divided up into several hundred semiautonomous domains overseen by powerful samurai known as daimyo. In these domains, the daimyo were free to set tax rates on local peasants as they saw fit. This included the most important tax, nengu, which claimed a portion of each domain’s rice yield. According to records from 1868, nengu rates varied wildly across these domains, from 15 percent to as much as 70 percent. Curious to see whether peasants had any impact on the rates they were subjected to, a team of researchers including Abbey Steele, a University of Amsterdam political scientist, analyzed the relationship between nengu rates and peasant tax rebellions recorded throughout the Tokugawa era. These revolts included hanran, large rebellions typically including thousands of peasants, and chosen, mass desertions in which peasants abandoned their fields and threatened not to return until their demands were met.

Steele and her colleagues found that, after controlling for various factors, the domains that experienced the most intense types of peasant tax resistance had, on average, nengu rates 5 percent lower than domains that did not. “Our work shows that peasants appear to have been able to influence the political development where they lived,” says Steele. While the team found that insurrections and desertions were associated with lower nengu rates, they can’t be certain that peasant resistance by itself caused the tax rate to drop. It is also unclear how recorded nengu rates were implemented in practice. Nevertheless, the researchers’ findings illustrate that even people who may seem to be at the mercy of all-powerful rulers will go to great lengths in search of a tax break.

Aztec Itemized Returns

By ERIC A. POWELL

Tuesday, March 23, 2021

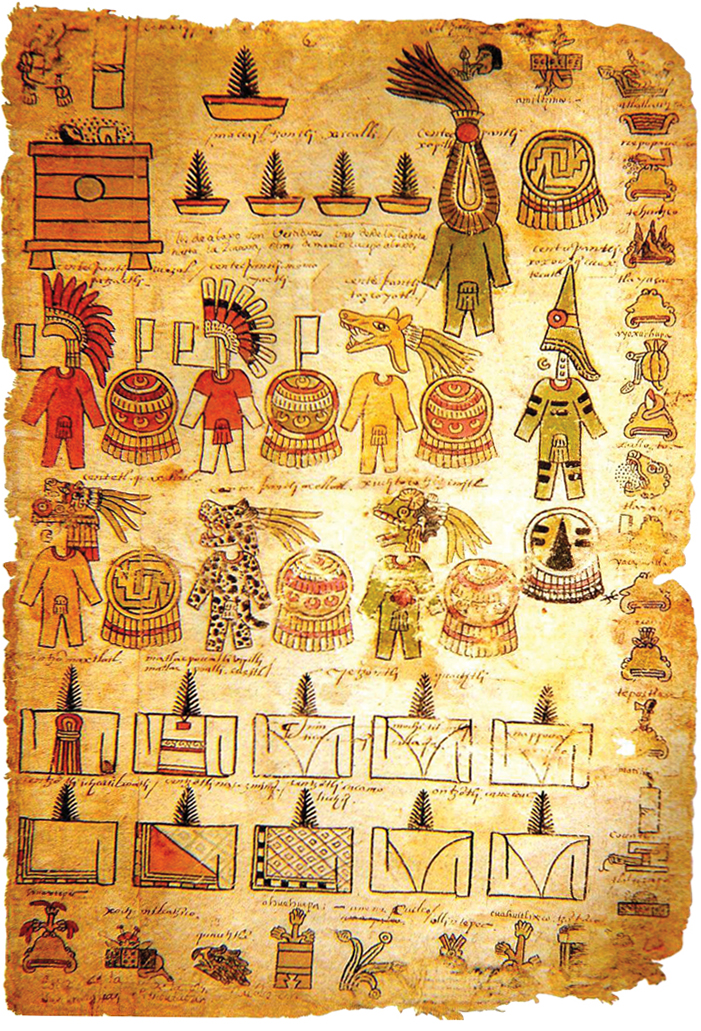

Before the Spanish arrived in 1519, the highest officials of the Aztec Empire could count on the provinces they ruled for an annual yield of 40 jaguar skins, 70 gold bars, 2,200 pots of bee honey, 4,000 loaves of salt, 16,000 rubber balls, and two live eagles, among many, many other items. One province alone was responsible for supplying 128,000 textiles. This expansive inventory is enumerated in a lavishly illustrated codex known as the Matrícula de Tributos, a pictographic narrative that details which goods each province owed to the empire. Scholars have traditionally regarded these as a kind of tribute paid by conquered states rather than as taxes, but Arizona State University archaeologist Michael E. Smith disagrees. “Tribute is booty,” he says. “That’s what a pirate takes. What the Aztecs were doing was definitely taxation.” Smith has identified a bewilderingly complex system of at least 11 different types of taxes levied at the Aztec imperial and city-state level.

Before the Spanish arrived in 1519, the highest officials of the Aztec Empire could count on the provinces they ruled for an annual yield of 40 jaguar skins, 70 gold bars, 2,200 pots of bee honey, 4,000 loaves of salt, 16,000 rubber balls, and two live eagles, among many, many other items. One province alone was responsible for supplying 128,000 textiles. This expansive inventory is enumerated in a lavishly illustrated codex known as the Matrícula de Tributos, a pictographic narrative that details which goods each province owed to the empire. Scholars have traditionally regarded these as a kind of tribute paid by conquered states rather than as taxes, but Arizona State University archaeologist Michael E. Smith disagrees. “Tribute is booty,” he says. “That’s what a pirate takes. What the Aztecs were doing was definitely taxation.” Smith has identified a bewilderingly complex system of at least 11 different types of taxes levied at the Aztec imperial and city-state level.

Taxes paid at the city-state level were probably much more significant to the average Aztec citizen than those recorded in the colorful record seen in the codex. “The empire worked almost like a mafia protection racket between the various city-states,” says Smith, “and the average person would have seen almost no return on imperial taxes.” On the other hand, local land and market taxes, which were often paid in cacao beans or cotton, funded canals and dams, on which all Aztecs relied. The local system was so efficient and entrenched that in 1532, a Spanish official wrote of the Aztecs that “the activity of paying taxes is so well understood, that I expect they will be paying taxes in gold and silver in no time.”

Flexible Tax Brackets

By LING XIN

Tuesday, March 23, 2021

Chinese historians have long assumed that under China’s earliest imperial rulers, the Qin (221–206 B.C.) and Han (206 B.C.–A.D. 220) Dynasties, farmers turned over a fixed amount of their crops to the state as a land tax. In recent years, the discovery of official documents in the form of bamboo slips with inked characters has given scholars new insight into the early Chinese taxation regime. These include examples from a collection of more than 36,000 such bamboo slips discovered by archaeologists in wells at the Qin Dynasty site of Liye. One slip features one of the earliest known multiplication tables. Nankai University historian Zhenhong Yang examined nearly 100 Qin and Han Dynasty bamboo slips related to taxation and found that the system was more sophisticated than previously thought.

Chinese historians have long assumed that under China’s earliest imperial rulers, the Qin (221–206 B.C.) and Han (206 B.C.–A.D. 220) Dynasties, farmers turned over a fixed amount of their crops to the state as a land tax. In recent years, the discovery of official documents in the form of bamboo slips with inked characters has given scholars new insight into the early Chinese taxation regime. These include examples from a collection of more than 36,000 such bamboo slips discovered by archaeologists in wells at the Qin Dynasty site of Liye. One slip features one of the earliest known multiplication tables. Nankai University historian Zhenhong Yang examined nearly 100 Qin and Han Dynasty bamboo slips related to taxation and found that the system was more sophisticated than previously thought.

The artifacts reveal that, under the Qin and Han Dynasties, taxes actually fluctuated from year to year, and even from field to field, because local officials took into account soil conditions, weather, and crop yield before determining what was owed. The bamboo slips show that officials followed a procedure that involved inspecting all the land farmed by a particular village, after which they exempted fields that failed to produce. Then, they sampled each taxable field to determine what its actual harvest should be for that year. Finally, they calculated the amount of taxes for each household. “This process seems cumbersome,” says Yang, “but the intention was to maintain fairness and reduce corruption among local officials.”

The Kings’ Dues

By JARRETT A. LOBELL

Tuesday, March 23, 2021

Which came first, the taxes or the kings? It seems logical that in order for there to be taxes, there has to be some sort of central authority to administer them. But what if it were actually the taxes that were the kingmakers? That, according to zooarchaeologist Pam Crabtree of New York University, is what happened in the Anglo-Saxon period (A.D. 410–1066) in England. The end of Roman Britain and the demise of its towns and cities in the early fifth century A.D. left an administrative vacuum across the island. In the short term, people returned to a more self-supporting Iron Age lifestyle with no central government and focused on consuming the food and goods they produced locally. As the centuries went on, Crabtree explains, farmers began to produce agricultural surpluses, setting England’s inhabitants on a different course—one that included taxes. Soon, local chieftains began to claim these surpluses for their own enrichment. This eventually allowed them to declare themselves royalty. “Taxation is an important way in which this agricultural surplus can be mobilized,” says Crabtree. “The taxes and the kings grew in tandem and this led to the emergence of new kingdoms.”

Which came first, the taxes or the kings? It seems logical that in order for there to be taxes, there has to be some sort of central authority to administer them. But what if it were actually the taxes that were the kingmakers? That, according to zooarchaeologist Pam Crabtree of New York University, is what happened in the Anglo-Saxon period (A.D. 410–1066) in England. The end of Roman Britain and the demise of its towns and cities in the early fifth century A.D. left an administrative vacuum across the island. In the short term, people returned to a more self-supporting Iron Age lifestyle with no central government and focused on consuming the food and goods they produced locally. As the centuries went on, Crabtree explains, farmers began to produce agricultural surpluses, setting England’s inhabitants on a different course—one that included taxes. Soon, local chieftains began to claim these surpluses for their own enrichment. This eventually allowed them to declare themselves royalty. “Taxation is an important way in which this agricultural surplus can be mobilized,” says Crabtree. “The taxes and the kings grew in tandem and this led to the emergence of new kingdoms.”

One tax Middle and Late Anglo-Saxon kings relied on was called feorm in Old English. This was a tax paid to the king and his entourage as he traveled across his kingdom to settlements in royal territories known as vills. The tax consisted of a healthful variety of foodstuffs and animal products, including honey, pigs, and wool. In the Middle Anglo-Saxon period (ca. A.D. 650–850), kings also increasingly came to rely on tolls paid in coin—evidence of a return to a type of monetized economy that hadn’t existed since the Roman period—on goods coming through trading settlements known as wics or emporia. One such spot was Lundenwic, Anglo-Saxon London. These emporia eventually led to the rebirth of towns and cities. The Anglo-Saxons were so successful at collecting taxes that it may have spelled their downfall. “One of the main reasons why England was so attractive to the Vikings, and eventually to the Normans,” says Crabtree, “is because the country had become a very wealthy place.”

Filling the Coffers

By BENJAMIN LEONARD

Tuesday, March 23, 2021

Citizens of the Roman Republic (509–27 B.C.) were occasionally required to pay tributum, a tax that helped finance the state’s activities. As Rome conquered its neighbors, land and the spoils of war were confiscated to replenish the Republic’s coffers. After defeating the Kingdom of Macedonia in 168 B.C., however, the Romans had amassed so much territory that they no longer needed to collect tributum from citizens in Italy. Instead, they could maintain their large army and fuel further expansion solely by taxing conquered provinces in Spain, Gaul, North Africa, and Asia Minor. “Taxes were a price that provincial communities paid because they had been subjugated,” says historian Peter Fibiger Bang of the University of Copenhagen. “In a way, it was a system of oppression. On the other hand, this oppression was maintained by the Roman army, which also kept the peace and offered a kind of protection.”

Citizens of the Roman Republic (509–27 B.C.) were occasionally required to pay tributum, a tax that helped finance the state’s activities. As Rome conquered its neighbors, land and the spoils of war were confiscated to replenish the Republic’s coffers. After defeating the Kingdom of Macedonia in 168 B.C., however, the Romans had amassed so much territory that they no longer needed to collect tributum from citizens in Italy. Instead, they could maintain their large army and fuel further expansion solely by taxing conquered provinces in Spain, Gaul, North Africa, and Asia Minor. “Taxes were a price that provincial communities paid because they had been subjugated,” says historian Peter Fibiger Bang of the University of Copenhagen. “In a way, it was a system of oppression. On the other hand, this oppression was maintained by the Roman army, which also kept the peace and offered a kind of protection.”

Under the emperor Augustus (r. 27 B.C.–A.D. 14), taxes on provincial land and agricultural products, as well as customs duties and taxes on inheritance and the sale of slaves, funded free grain for citizens of the city of Rome, infrastructure projects for the growing empire, and the standing army, by far the state’s biggest expenditure. Since the second century B.C., governors and, later, imperial officials had technically overseen taxation in the provinces. From the outset, however, rich tax collectors called publicani partnered to form private companies that bid at public auctions in Rome for the right to collect a province’s taxes for a five-year period. In turn, they offered their property as collateral. “The publicani were notorious,” Bang says. “Whatever surplus they could create was theirs to keep. They made sure they weren’t going to lose money, so they squeezed as much from the provincials as they could.” The Roman historian Tacitus writes that in response to complaints about the “excessive greed” of the publicani, the emperor Nero (r. A.D. 54–68) instituted strict reforms to curb their exploitative activities and decreed that tax laws should be posted publicly for transparency.

Advertisement

Page 1 of 2

Advertisement

IN THIS ISSUE

Advertisement

Recent Issues

-

May/June 2024

May/June 2024

-

March/April 2024

March/April 2024

-

January/February 2024

January/February 2024

-

November/December 2023

November/December 2023

-

September/October 2023

September/October 2023

-

July/August 2023

July/August 2023

-

May/June 2023

May/June 2023

-

March/April 2023

March/April 2023

-

January/February 2023

January/February 2023

-

November/December 2022

November/December 2022

-

September/October 2022

September/October 2022

-

July/August 2022

July/August 2022

-

May/June 2022

May/June 2022

-

March/April 2022

March/April 2022

-

January/February 2022

January/February 2022

-

November/December 2021

November/December 2021

-

September/October 2021

September/October 2021

-

July/August 2021

July/August 2021

-

May/June 2021

May/June 2021

-

March/April 2021

March/April 2021

-

January/February 2021

January/February 2021

-

November/December 2020

November/December 2020

-

September/October 2020

September/October 2020

-

July/August 2020

July/August 2020

-

May/June 2020

May/June 2020

-

March/April 2020

March/April 2020

-

January/February 2020

January/February 2020

-

November/December 2019

November/December 2019

-

September/October 2019

September/October 2019

-

July/August 2019

July/August 2019

-

May/June 2019

May/June 2019

-

March/April 2019

March/April 2019

-

January/February 2019

January/February 2019

-

November/December 2018

November/December 2018

-

September/October 2018

September/October 2018

-

July/August 2018

July/August 2018

-

May/June 2018

May/June 2018

-

March/April 2018

March/April 2018

-

January/February 2018

January/February 2018

-

November/December 2017

November/December 2017

-

September/October 2017

September/October 2017

-

July/August 2017

July/August 2017

-

May/June 2017

May/June 2017

-

March/April 2017

March/April 2017

-

January/February 2017

January/February 2017

-

November/December 2016

November/December 2016

-

September/October 2016

September/October 2016

-

July/August 2016

July/August 2016

-

May/June 2016

May/June 2016

-

March/April 2016

March/April 2016

-

January/February 2016

January/February 2016

-

November/December 2015

November/December 2015

-

September/October 2015

September/October 2015

-

July/August 2015

July/August 2015

-

May/June 2015

May/June 2015

-

March/April 2015

March/April 2015

-

January/February 2015

January/February 2015

-

November/December 2014

November/December 2014

-

September/October 2014

September/October 2014

-

July/August 2014

July/August 2014

-

May/June 2014

May/June 2014

-

March/April 2014

March/April 2014

-

January/February 2014

January/February 2014

-

November/December 2013

November/December 2013

-

September/October 2013

September/October 2013

-

July/August 2013

July/August 2013

-

May/June 2013

May/June 2013

-

March/April 2013

March/April 2013

-

January/February 2013

January/February 2013

-

November/December 2012

November/December 2012

-

September/October 2012

September/October 2012

-

July/August 2012

July/August 2012

-

May/June 2012

May/June 2012

-

March/April 2012

March/April 2012

-

January/February 2012

January/February 2012

-

November/December 2011

November/December 2011

-

September/October 2011

September/October 2011

-

July/August 2011

July/August 2011

-

May/June 2011

May/June 2011

-

March/April 2011

March/April 2011

-

January/February 2011

January/February 2011

Advertisement